DOGE Price Prediction: Can the Memecoin Reach $1?

#DOGE

- DOGE has broken key resistance levels and is showing strong bullish momentum

- Whale activity and institutional interest are supporting the current rally

- Technical indicators suggest potential resistance at upper Bollinger Band (0.274564)

DOGE Price Prediction

DOGE Technical Analysis: Bullish Signals Emerge

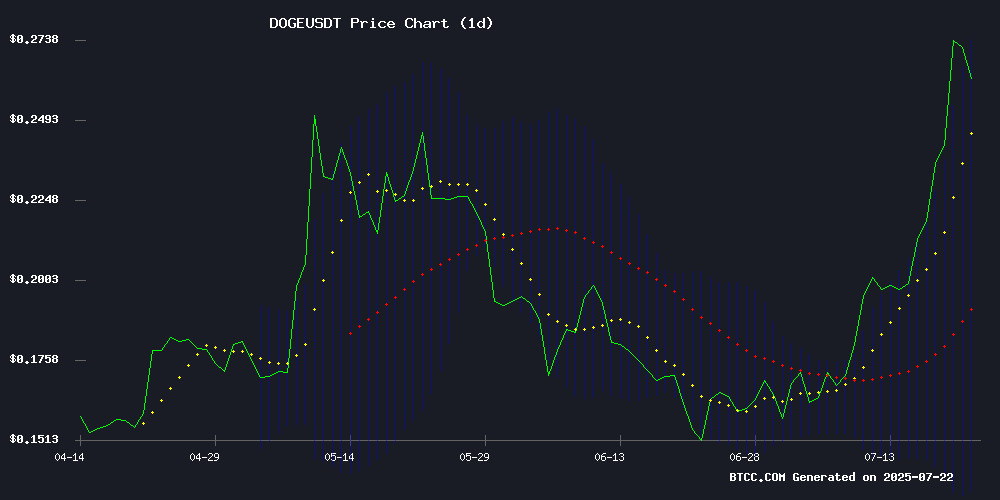

According to BTCC financial analyst Ava, Doge is currently trading at 0.26485000 USDT, significantly above its 20-day moving average of 0.204871. The MACD indicator shows bearish momentum with values at -0.042002 (MACD line), -0.027796 (signal line), and -0.014206 (histogram). However, the price is testing the upper Bollinger Band at 0.274564, which could indicate potential overbought conditions. The middle band at 0.204871 and lower band at 0.135177 suggest strong support levels below the current price.

Dogecoin Market Sentiment: Rally Continues Amid Whale Activity

BTCC financial analyst Ava notes that Dogecoin has shattered a 4-year bearish trend with a 65% July rally, according to recent news. The cryptocurrency has cleared key resistance levels and is now eyeing higher targets, with some speculation pointing to $10. Exchange balances reaching $7 billion may signal potential sell pressure, but whale activity remains strong with $250 million in recent purchases. Institutional interest is growing, as evidenced by Bit Origin's $500 million Dogecoin treasury plan.

Factors Influencing DOGE's Price

Dogecoin Price Prediction: DOGE Clears Key Resistance – $10 Next Target?

Dogecoin has slipped 2% to $0.2667 amid a broader market correction, yet maintains impressive weekly and monthly gains of 39% and 70% respectively. The meme coin's rally follows the GENIUS Act passage and ETF inflow growth, signaling renewed institutional interest.

Technical indicators now flash bullish signals. DOGE's weekly chart shows a decisive breakout from a descending channel pattern that had constrained price action since December. The RSI has crossed above 50, while the MACD nears a positive crossover—both historically reliable precursors to extended uptrends.

Market sentiment appears to be shifting fundamentally for meme coins. Dogecoin's enduring popularity and improving technical structure suggest potential for significant upside, with some traders eyeing ambitious long-term targets. The $10 price point remains speculative, but not implausible given crypto's history of parabolic moves during bull markets.

Dogecoin Shatters 4-Year Bearish Trend with 65% July Rally

Dogecoin has defied historical trends with a stunning 65% surge in July, marking its most bullish performance for the month on record. The meme coin broke through the $2.7 resistance level that had capped prices for months, simultaneously ending a four-year bearish streak that had haunted investors.

July typically ranks among Dogecoin's worst-performing months, averaging just 2.23% gains with median returns of -4.59%. This year's rally upends expectations, particularly as Q3 has historically been Dogecoin's weakest quarter—closing negative in eight of the past twelve years. The current momentum suggests a potential regime change for the cryptocurrency.

Dogecoin Exchange Balances Hit $7 Billion, Signaling Potential Sell-Off

Dogecoin faces mounting sell pressure as exchange balances surge to a six-month high. Over 26.1 billion DOGE, worth approximately $7 billion at current prices, now sit on centralized exchanges—a historical precursor to price declines.

Recent patterns suggest a troubling trend. In May, similar spikes preceded sharp drops: an 8.6% decline followed a May 11 peak, while a 33% crash occurred after May 23's balance increase. The current accumulation mirrors these conditions, potentially foreshadowing a drop from $0.265 to $0.22 or lower.

Compounding the concern, shrinking HODL Waves indicate weakening holder confidence. As long-term investors reduce positions, the market braces for extended downward pressure. "When this much supply sits on exchanges, it's not a matter of if—but when—the selling begins," notes a senior analyst at Glassnode.

DOGE Breaks $0.25 as Whales Buy $250M, Eyes $0.48 Target

Dogecoin surged past the $0.25 resistance level as whales accumulated over 1.08 billion DOGE tokens worth approximately $250 million within 48 hours. Trading volume spiked 77% to $6.43 billion, signaling renewed market interest amid speculation of a potential Dogecoin ETF and a major breakout by 2025.

The token climbed to $0.2720, marking a 7.83% daily gain, with a local high NEAR $0.29. Technical analysis confirms a bullish Double Bottom pattern, suggesting strong upward momentum. Institutional confidence appears to be growing, with concentrated whale activity reaching levels not seen in months.

Bit Origin's $500M Dogecoin Treasury Plan Fuels Rally Speculation

Dogecoin surged 31% this week, reaching $0.27 amid bullish technical patterns and institutional interest. Bit Origin's proposed $500 million treasury project marks a significant shift in DOGE's perception from meme coin to institutionally backed asset.

The breakout from a cup-and-handle formation suggests potential for further gains, with analysts eyeing $0.35 as the next resistance level. Momentum indicators like the Money FLOW Index at 89.12 underscore strong buying pressure.

While retail investors focus on DOGE's price action, institutional players appear to be recognizing its growing utility. The double-bottom pattern observed by chart watchers hints at a possible retest of 2021 highs.

Dogecoin Leads Memecoin Rally with 77% July Gains as On-Chain Metrics Signal Further Upside

Dogecoin has emerged as the standout performer in the memecoin sector, posting a staggering 77% gain in July - the largest rally among top memecoins by market capitalization. The breakout from its April consolidation pattern suggests potential for another 20% upward move, with on-chain data revealing healthy network activity without signs of excessive profit-taking.

Santiment data shows daily active addresses gradually increasing throughout July, avoiding the frenzy-like spikes that typically precede local tops. Transaction counts mirror this trend, indicating sustained interest without bubble-like capitulation. The 365-day circulation metric's upward trajectory since May hints at growing adoption, with new participants entering even as some long-term holders take profits.

Technical analysis reveals a trading range between $0.142 and $0.25 since March, with Sunday's breach of range highs confirming bullish momentum. Market observers note Dogecoin's leadership in the memecoin recovery, with its price action and on-chain metrics aligning to suggest the rally may have further room to run.

Will DOGE Price Hit 1?

While DOGE has shown strong performance recently, reaching $1 would require a nearly 4x increase from current levels. The technical indicators show mixed signals: the price is above key moving averages but MACD remains bearish. News sentiment is overwhelmingly positive with institutional interest growing. Key factors to watch include:

| Factor | Current Status |

|---|---|

| Price | 0.26485000 USDT |

| 20-day MA | 0.204871 (support) |

| Upper Bollinger Band | 0.274564 (resistance) |

| Whale Activity | $250M recent purchases |

| Exchange Balances | $7B (potential sell pressure) |

While $1 is possible in an extreme bullish scenario, more realistic short-term targets would be in the $0.48-$0.60 range based on current technicals and market sentiment.